net investment income tax 2021 calculator

For tax years beginning after Dec. The adjusted gross income.

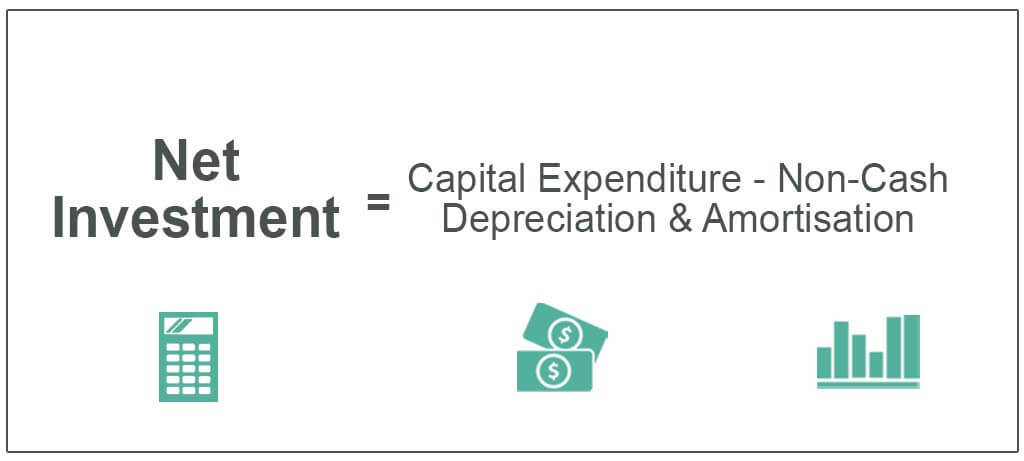

Net Operating Profit After Tax Calculator Efinancemanagement

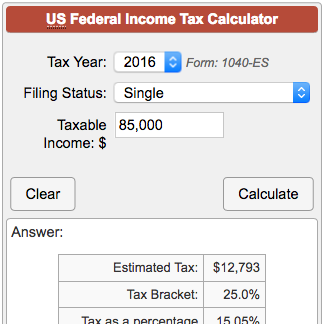

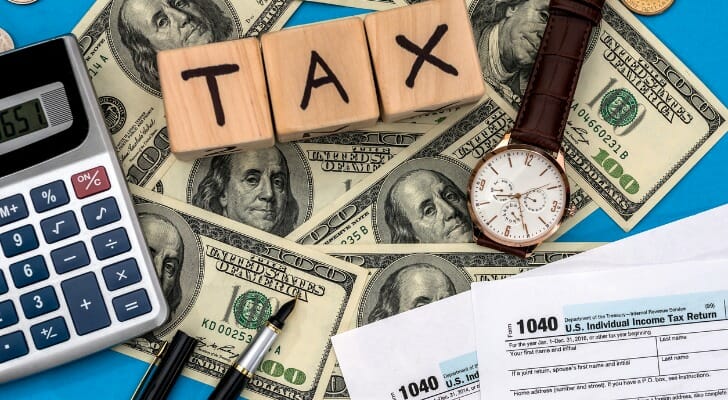

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

. In summary the taxable value from 1 January 2023 onwards is now calculated based on a combination of the emission levels of the car and the total business mileage carried out. Note that this amount is significantly lower than 2021. And is based on the tax brackets of 2021 and.

These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are determined. The threshold amounts are based on your filing status. In 2021 the tax credit was up to a.

Use this 1040 tax calculator to help estimate your tax bill for the current tax years rates and rules. Long-term capital gains are gains on assets you hold for more than one year. We are only required by the IRS to indicate annuity distributions.

20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases. We earlier published easy NIIT. Single or head of household 200000.

For more information on the Net Investment Income Tax refer to Tax. Theyre taxed like regular income. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file.

This calculator includes the same taxes and tax credits as the. In the case of an estate or trust the NIIT is 38 percent on the lesser of. We do not calculate the potential tax consequence.

The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the. This tax is also known as the net investment income tax NIIT. It is mainly intended for residents of the US.

This is the detailed computation of the Net Investment Income Tax which is regulated by section 1411 of the Internal Revenue Code. B the excess if any of. Additionally health and education.

That means you pay the same tax rates you pay on federal income tax. A the undistributed net investment income or. If income is moved from other income to Canadian dividends total taxes will be reduced even as the OAS clawback increases.

Married filing jointly or qualifying. For tax years beginning on or before Dec. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Net Investment Definition Formula Step By Step Calculation

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Capital Gains Tax Calculator Estimate What You Ll Owe

Short Term Capital Gains Tax Rates For 2022 Smartasset

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet

:max_bytes(150000):strip_icc()/GettyImages-1160172463-9d00a407bf63428a9bb030b683d1c863.jpg)

What Is The Net Investment Income Tax

Understanding Crypto Taxes Coinbase

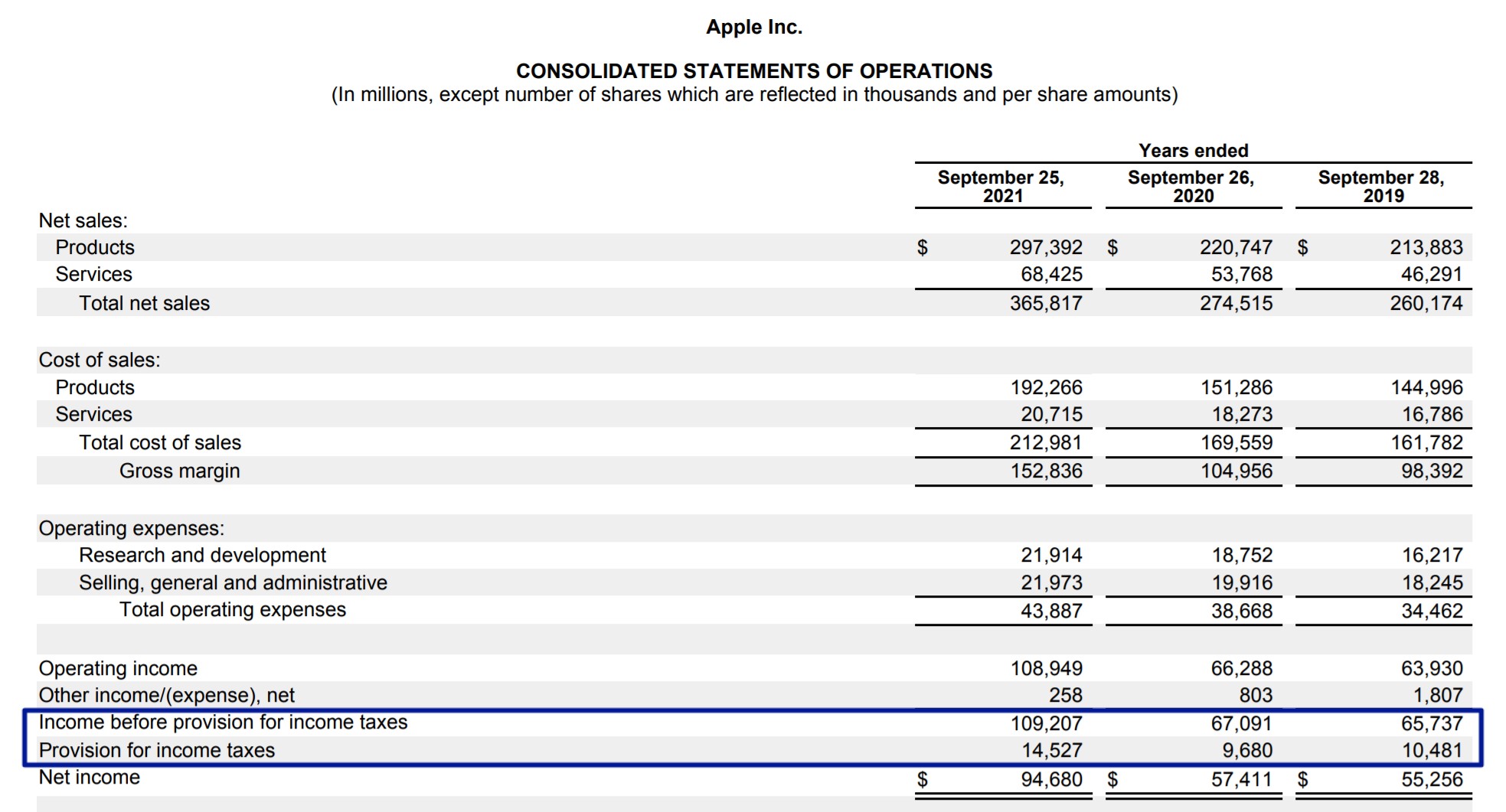

Net Income Formula And Calculator Step By Step

Investment Expenses What S Tax Deductible Charles Schwab

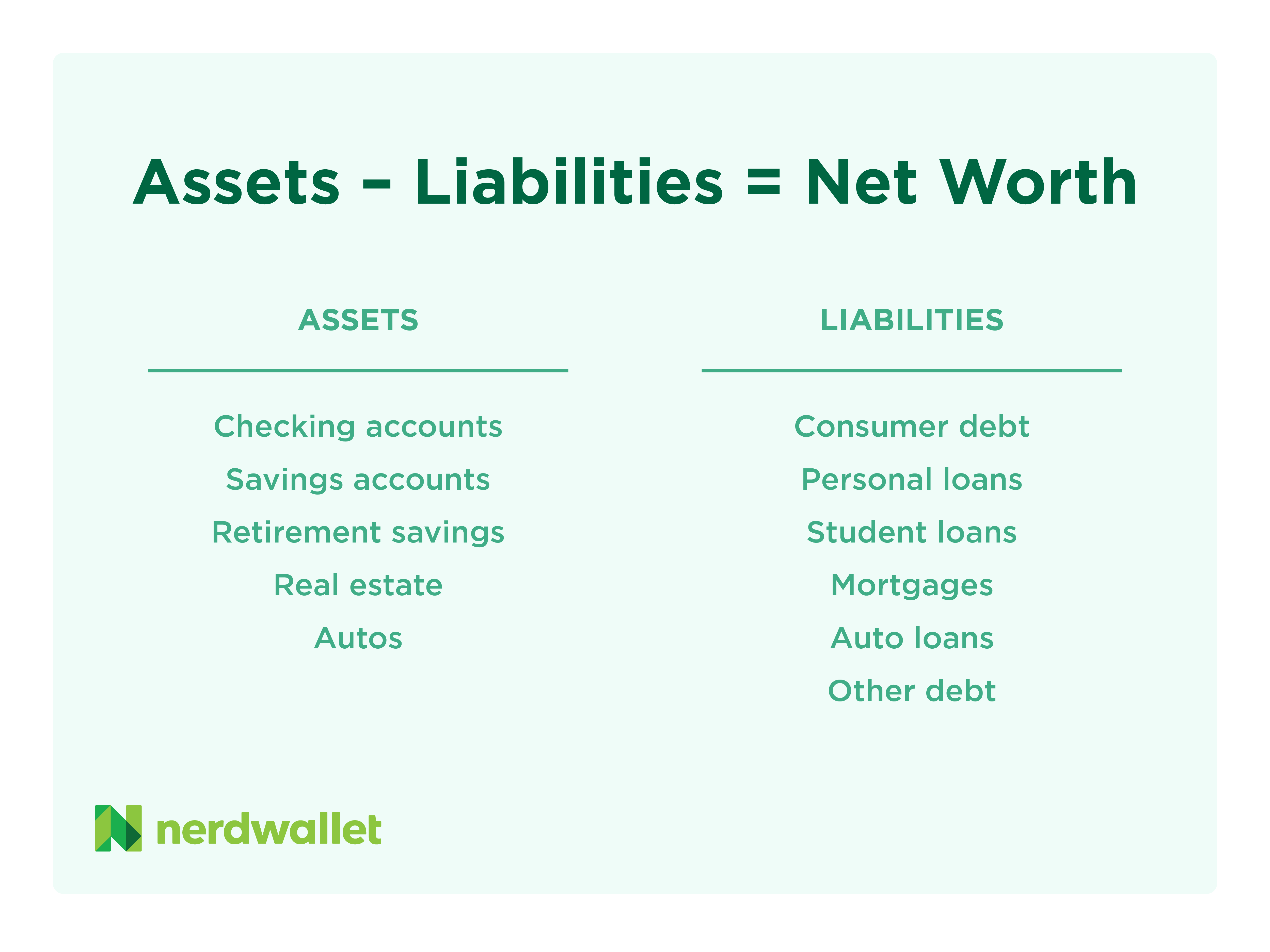

Net Worth Calculator Find Your Net Worth Nerdwallet

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Effective Tax Rate Formula And Calculator Step By Step

Calculator For Net Investment Income Medicare Tax

How To Calculate The 3 8 Net Investment Income Tax Niit Youtube

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

What You Need To Know About Capital Gains Tax

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income